Texas Real Estate 2025: The Surprising Trends Shaping the Next Decade of Investing

- naorbiringer

- Dec 15, 2025

- 4 min read

Why smart investors are shifting toward land, alternative commercial assets, and strategic development across Texas.

Texas Didn’t Just Survive 2025 — It Quietly Reset the Rules of Real Estate Investing

2025 will be remembered as a turning point year for Texas real estate. While national headlines focused on interest rates, election uncertainty, and affordability concerns, something far more important was happening beneath the surface.

Texas real estate didn’t slow down it recalibrated.

Investor behavior matured. Capital became more selective. Development shifted away from overcrowded metros and toward strategic corridors. And the foundation was laid for what may become the most profitable decade of real estate investing Texas has ever seen.

At B Tree Investments Group, we spent 2025 structuring land development projects, underwriting commercial assets, launching RV park and self-storage opportunities, and guiding investors through this transition in real time. The trends outlined below are not theory — they’re based on what we executed on the ground.

This article breaks down the real forces shaping Texas real estate through 2035, where the smartest investors are positioning now, and how we help our clients capitalize before the next wave becomes mainstream.

Trend #1: Texas Migration Didn’t Slow—

It Became Smarter and More Targeted

The idea that Texas migration has peaked is misleading.

What actually happened in 2025 was a migration recalibration.

Buyers and investors moved away from headline-driven metros and began targeting:

High-growth suburban markets

Secondary cities with expanding infrastructure

Rural-edge corridors with utility access and development feasibility

Land positioned near future employment and logistics hubs

This shift created outsized demand for land, development sites, RV parks, and suburban commercial properties—especially in North and East Texas.

Why This Matters for Investors

Texas growth is no longer speculative. It’s infrastructure-led and corridor-driven. Investors who understand where growth is going—not just where it’s been—will outperform over the next decade.

Trend #2: 2025 Marked the Start of a New, More Disciplined Growth Cycle

Interest rate easing in 2025 did more than improve affordability—it changed capital behavior.

Unlike the aggressive, retail-heavy surge of 2020–2021, this cycle is defined by selectivity.

Investors increasingly favored:

Development land with defined exit strategies

Build-to-rent and mixed-use sites

Self-storage facilities with stable demand

RV parks and alternative commercial assets

Capital is no longer chasing quick appreciation. It’s seeking durable cash flow, scalability, and inflation protection.

What This Signals for 2026–2030

Texas real estate is entering a longer, steadier expansion phase. Those who deploy capital early—before competition intensifies—stand to capture both appreciation and cash flow over the full cycle.

Trend #3: Texas Development Corridors Are Replacing Metro Cores as Wealth Drivers

One of the most underreported stories of 2025 was the acceleration of development corridors.

Infrastructure investment, logistics demand, and population spillover pushed growth outward—creating new zones of opportunity along major highways and regional connectors.

Key Texas Growth Corridors to Watch

Corridor / Region | Primary Drivers | Long-Term Opportunity |

I-30 / I-20 (DFW to East TX) | Logistics, affordable land | Land development, storage, BTR |

Dallas–Greenville–Texarkana | Migration + infrastructure | Suburban commercial, RV parks |

HWY 380 Expansion | Employment growth | Mixed-use, residential land |

Austin–San Antonio Belt | Population density | Development & commercial hubs |

Houston Outer Loop Zones | Industrial demand | Storage & service-based CRE |

At B Tree, these are the exact corridors where we focus feasibility analysis, land acquisition, and investor-ready development planning.

Trend #4: Land Development Became the Preferred Risk-Adjusted Strategy

2025 reinforced a critical truth: investors want control.

Land development offers what many other asset classes cannot:

Lower holding costs

Multiple exit strategies

Flexibility across market cycles

Strong appreciation potential

Protection against short-term volatility

As residential competition increased, land positioned for future development became one of the most sought-after investment vehicles in Texas.

Why Investors Are Shifting Toward Development

Instead of betting on resale timing, investors are choosing assets where value is created through planning, entitlements, utilities, and execution—not speculation.

This is where structured development expertise matters most.

Trend #5: Alternative Commercial Assets Quietly Outperformed Traditional Plays

While much of the market focused on housing affordability, alternative commercial real estate outperformed expectations.

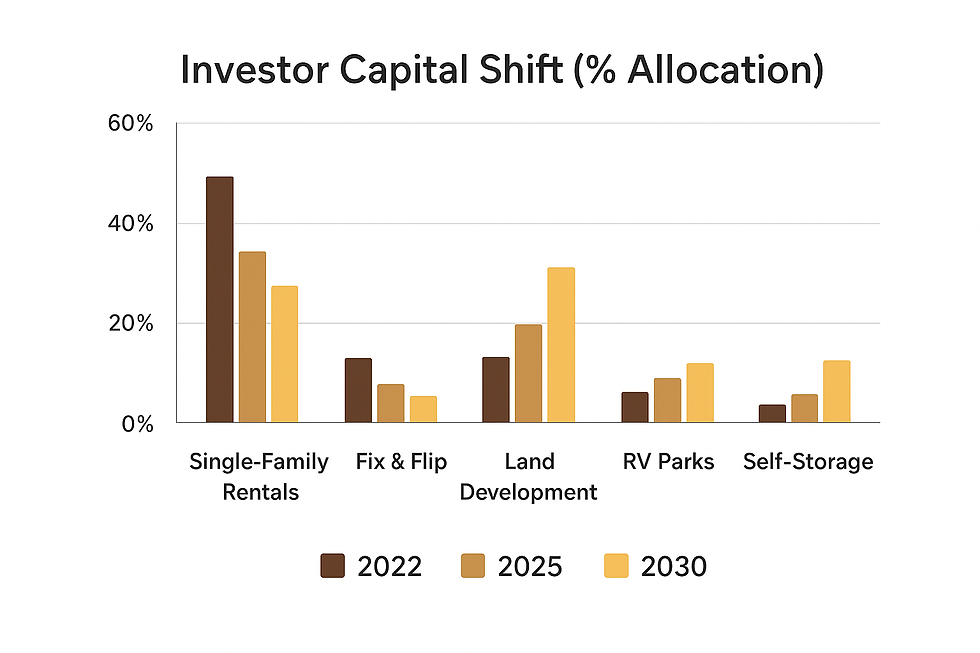

Investor Capital Shift (Indicative Trends)-

Asset Class | 2022 Focus | 2025 Focus | 2030 Outlook |

Single-Family Rentals | High | Moderate | Stabilized |

Fix & Flip | Moderate | Low | Declining |

Land Development | Growing | Strong | Core strategy |

RV Parks | Emerging | High | Institutionalized |

Self-Storage | Stable | Very Strong | Defensive leader |

RV parks and self-storage stood out for one reason: they perform in both expansion and contraction cycles.

That resilience is why B Tree continues to prioritize these assets for investors seeking predictable income with upside.

The Bigger Picture: Texas Entered Its Largest Real Estate Wealth Transfer Phase

Perhaps the most important takeaway from 2025 is this:

Texas real estate is entering a multi-year wealth transfer period.

Key drivers include:

Aging landowners monetizing assets

Builders expanding into secondary markets

Investors rotating out of overheated metros

Favorable long-term tax and business conditions

This is not a short-term opportunity. It’s a decade-long repositioning of capital—and those who enter early will benefit most.

How B Tree Investments Group Helps Investors Win in the Next Decade?

At B Tree Investments Group, our role isn’t transactional—it’s strategic.

We help investors navigate Texas real estate by providing:

Land acquisition and development planning

RV park and self-storage project execution

Commercial feasibility and market analysis

Investor-ready opportunities with defined strategies

Long-term guidance aligned with portfolio goals

Our focus is simple: projects designed to perform across cycles, not chase trends.

What 2025 Really Taught Us About the Future of Texas Real Estate?

Texas real estate isn’t slowing down—it’s evolving.

The next decade will reward investors who prioritize:

Early positioning

Corridor-based growth

Alternative commercial assets

Strong development partners

Long-term thinking over short-term hype

These are the principles we apply every day—and the foundation of how we help investors build durable wealth.

Planning to Invest in Texas Real Estate in 2026? Start Positioning Now

The most successful investors don’t wait for confirmation—they prepare in advance.

Our private investor network receives:

Early access to land and development opportunities

RV park and self-storage projects with strong fundamentals

Market insights based on real execution—not headlines

Direct access to work with Naor Biringer and the B Tree team

If your goal is to build serious, long-term wealth through Texas real estate, this is the moment to connect.

Naor Biringer

Commercial Investor & Realtor®

B Tree Investments Group

.png)

Comments